costa rica taxes for canadian expats

Income taxes for tax residents in Costa Rica are set at a progressive rate which range from 0 percent to 25 percent. Every individual employed in Costa Rica must pay a monthly withholding tax that is based on hisher salary.

How To Retire In Costa Rica From Canada 4 Simple Steps

Tell us a little bit about you and what made you move to Costa Rica.

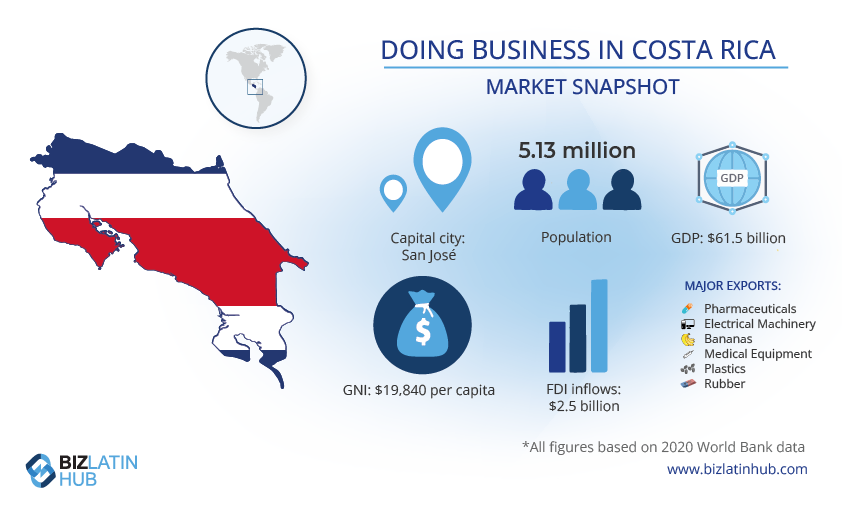

. Active companies pay 25 of Costa Ricas minimum salary or 112500 colons 200 and inactive entities pay 15 or 67530 colons 120. As a result we have been receiving a number of questions from expats living in Costa Rica regarding the countrys tax system social security benefits how to minimize a US expat taxes and whether or not we are able to provide US expatriate tax services to American expats. Income subject to tax in this country includes employment income self-employment business income investment income directors fees and capital gains.

Corporation Tax Rates in Costa Rica. Costa Rica requires at least 1000 in monthly income from sources such as Social Security or pensions in order to qualify for residency. Costa Rica staff More Canadians expats have become the latest target of US.

I grew up in a small town of central British Columbia Canada named Williams Lake. Excessive taxation is nothing less than legalized theft. Furthermore there is no capital gains tax and annual property tax is only 025 meaning Canadians are often drawn to Costa Ricas financial appeal.

We started with a few words of caution however Costa Rica can be an amazing and happy place to move to and that being said safe. The tax is levied on both employment source income and non-employment source income. Although not very big the country is diverse so which regions should you choose to settle in and why.

You can request an extension on your US expat taxes until October 15 if you need more time to file. Similar to how you settled taxes with the IRS prior to moving to Costa Rica you will need to settle tax issues with Costa Ricas Ministry of Finance. Expats are Leaving Costa Rica to Avoid the Vaccine Mandate.

Once you become a tax non-resident of Canada the Canadian government banks will withhold 30 of your income CPP pensions dividends income trusts etc. In Costa Rica income tax rates are progressive. This theft deprives many Canadians of having enough money to send their children to.

The Canadian Broadcasting Corp. Growing up I always enjoyed the outdoors and activities like mountain biking snowboarding skiing snowmobiling dirt biking hunting and fishing the. Does Costa Rica have income tax.

Is reporting that 900000 copies of Canadian expats citizens bank records have been shared with the US. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income. Meet Jason Canadian Expat in Costa Rica.

Canadian pundits expect expat exodus from Hong Kong. However if youre a non-tax resident your income tax rate will fixed at either 10 percent 15 percent or 25 percent depending on the income type and is withheld by your employer. The US tax year runs January to December with US resident returns due in April and US expat tax returns due June 15.

Top 5 Safest Places in Costa Rica for Expats. Expats in Costa Rica talk about the best places for families to live in Costa Rica. InterNations helps you meet and interact with other Canadians in Costa Rica living in San José Quesada Alajuela and many other places across the country.

Costa Rica is known for its splendid beaches along both the Pacific and Caribbean coastlines with steaming volcanoes and immense biodiversity. In Costa Rica the tax year is October 1 to September 30 and your return must be filed by February 15 each year. Costa Rica is also a popular safe haven for citizens of Latin America.

As the Hong Kong protests against Chinas extradition bill continue China watchers in Canada are predicting an expat exodus. So heres why Im leaving Canada even though I was born here 62 years ago for Costa Rica. Liisa is a Canadian writer and author.

From the cool climate of the Central Valley to the beautiful beach towns in Gaunacaste and Costa Ballena proximity to international and bilingual schools safety and. It is not an income tax but just a charge by the government for using a company structure to hold assets instead of in a personal name. Its also quite easy to become a tax resident of Costa Rica and nullify any Canadian tax liability.

Income tax on wages and income tax on profit generating activities. Active corporations that earn up to 51 million have to pay 25 of minimum wage yearly 106250. Non-active corporations have to pay 15 of minimum wage yearly 63750.

Employment income on a monthly basis of individuals is subject to a tax of up to 15. You will become a tax resident of CR and you will have to pay taxes on CR income. She began her writing career specializing in the health sector but as her life evolved she began writing about being a location independent family living abroad with kids.

The income earned in other countries will be taxed at the source by withholding taxes. The warm climate and cost of living is compelling a growing number of Americans to move to Costa Rica. Costa Rica income tax rates are progressive between 0-25.

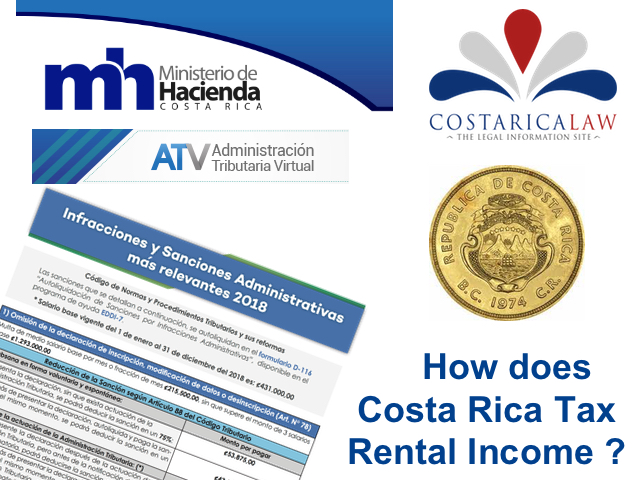

These days Liisa lives in Tamarindo Costa Rica with her husband and two boys ages 7 and 9. This tax is triggered with the transfer of the property. There are 2 different types of income taxes in Costa Rica.

What you pay is based on the income you used to qualify for residency typically 75 to 100 per month for a retired expat couple. There are 24201 United States citizens with residency in Costa Rica and 3639 from Canada. Expats who derive their income from foreign sources foreign pensions and investments for example do not have to pay income tax while living in Costa Rica.

Costa Rica is very popular with expats especially from the USA as an affordable retirement destination. The number of 2018 records is about a third more than was sent the previous year. Your social security registration with CAJA will also need to be discontinued.

Heres a list of the top 5 safest places to live in Costa Rica. At the present time. Corporations that earn between 51 million and 119 million have to pay 30 of minimum wage yearly 127500.

Governments in Canada take approximately 50 of our earned incomes each year in various forms of tax. A declaration must be filed in the San Jose location. Tamarindo has one of the best and tranquil beaches found in Costa Rica.

Income taxes for tax residents in Costa Rica are set at a progressive rate which range from 0 percent to 25 percent. The vast majority of foreign residents in Costa Rica come from the neighboring country of Nicaragua with 329066 citizens. Here is the list of the best places to live in Costa Rica.

The country is now home to 7792 Venezuelans. The regular exchange with your Canadian compatriots is also an important aspect of the expat experience and can help you get accustomed to the Costa Rican culture and people. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income.

Latest News Relating to Costa Rica or Canada. Terminating your Social Security. For the self-employed the rates range from 10 to 25.

Most countries around the globe including Canada have some form of income tax that residents are obligated to pay.

What Are Property Taxes Like In Costa Rica Mansion Global

Planning A Long Term Visit To Costa Rica Two Weeks In Costa Rica

Costa Rican Taxes For U S Expats 8 Things To Know About Tax Returns

Tax Guide For Americans Living In Costa Rica Greenback Expat Tax Services

Country Of The Month Costa Rica Advisor S Edge

Starting A Business In Costa Rica As An Expat Two Weeks In Costa Rica

The Taxation System In Costa Rica Tax In Costa Rica

Starting A Business In Costa Rica Why And How Biz Latin Hub

Expat Financial Advisor In Costa Rica In 2021 Adam Fayed

How Many Foreigners Live In Costa Rica Costaricalaw Com

Does Costa Rica Have A Tax Treaty With Canada Cubetoronto Com

International Living In Costa Rica Costaricalaw Com

Retire In Costa Rica The Switzerland Of Central America Retirepedia Retiring In Costa Rica Living In Costa Rica Costa Rica

Panama Vs Costa Rica For Retirement The Golden Flip Flop

Costa Rica Cost Of Living 2022 How Much To Live In Costa Rica

How Is Rental Income Taxed In Costa Rica Costaricalaw Com

Tax Requirements And Compliance For Vacation Rentals In Costa Rica Caribbean Property Management Services In Costa Rica Green Management

Opening A Bank Account And The Tax System In Costa Rica Internations